How To Get The Most From Your First Party Data

04 Nov

On May 25 2018, the EU introduced the General Data Protection Regulation (GDPR), changing how businesses and organisations handle customer information.

For the first time, businesses needed actively confirmed consent from customers before they could start collecting data.

Overnight, businesses with rich first party data were given a significant boost, while third party cookie based data – which had traditionally been cheap and readily available – started to present new challenges.

“One of the biggest things we’re seeing is that GDPR and additional scrutiny have accelerated the importance of first-party data and fostering relationships through channels,” Braze co-founder Bill Magnuson told Clickz recently.

First party data broadly refers to data that has been collected directly through a company website, including email address, demographic information and purchase activity. This type of data is often collected through newsletters, whitepapers or any other downloadable content.

It can also be collected using cookies which track browsing behaviour or through an app.

This means that whether they know it or not, most businesses will already have some first party data on hand.

However, first party data remains underutilised by many.

In a recent study, the World Federation of Advertisers found 58 percent of businesses in APAC believe their first party data is fully or significantly utilised. Globally this figure dropped to 28 per cent.

One proven use case for first party data application is to create a customer segmentation. This can be done using basic techniques right up to using advanced analytics. Customer segmentations are a great way to prioritise customer management and gain a deeper understanding of existing users.

Additionally, this first party data can be used to create a personalised experience for current users.

Getting the mix right

While first party data has its advantages in a privacy-centric world, it also has clear limitations, specifically in terms of scale and breadth.

For example, if a business is looking to build an audience segment using first party data, it will only be able to create this based on information about pre-existing customers/users.

This, in turn, will hinder the performance of the segment.

Given these limitations, first party data is best utilised when it is enriched with extra data to ‘supercharge’ performance.

Businesses might exchange their data with another company to secure second party data.

Alternatively, in situations where there is not enough first party data to create sufficient insights, it is not uncommon for businesses to call upon third party data marketplaces to improve results.

When we talk about third party data, we are traditionally talking about data that contains demographic, socio-economic, and online behavioural data from a variety of sources. While less commonly available, offline transactional data is becoming more important.

If a business is experiencing a churn problem, for example, it could combine its existing first party data with third party information to build a higher performing churn model that shows which users are more likely to stop engaging with the business.

First party data paints a picture of who the customer is for any business. But it is only once this data is combined with third party data that they can start to understand what changes are needed to make products and services for both customers and prospects.

Digital marketing and advertising association IAB Europe recently described combining first party and third party data as “a winning equation”.

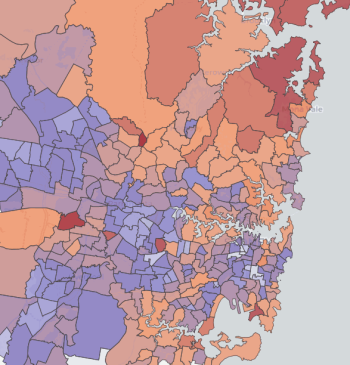

At smrtr, we combine our data – which is based on the purchase behaviour and characteristics of 16 million Australians – with our customer’s first party data to uncover deeper meaning and insights.

Combining first party and third party data in this manner allows us to ‘close the gap’, find the patterns that are relevant to your business and enable significantly more efficient media targeting.

smrtr’s Insight and Advisory services custom build data solutions that meet specific client needs.

If you’d like to learn more please, contact us and we’ll be in touch within the next business day.

By Steve Millward, General Manager – Commercial at smrtr