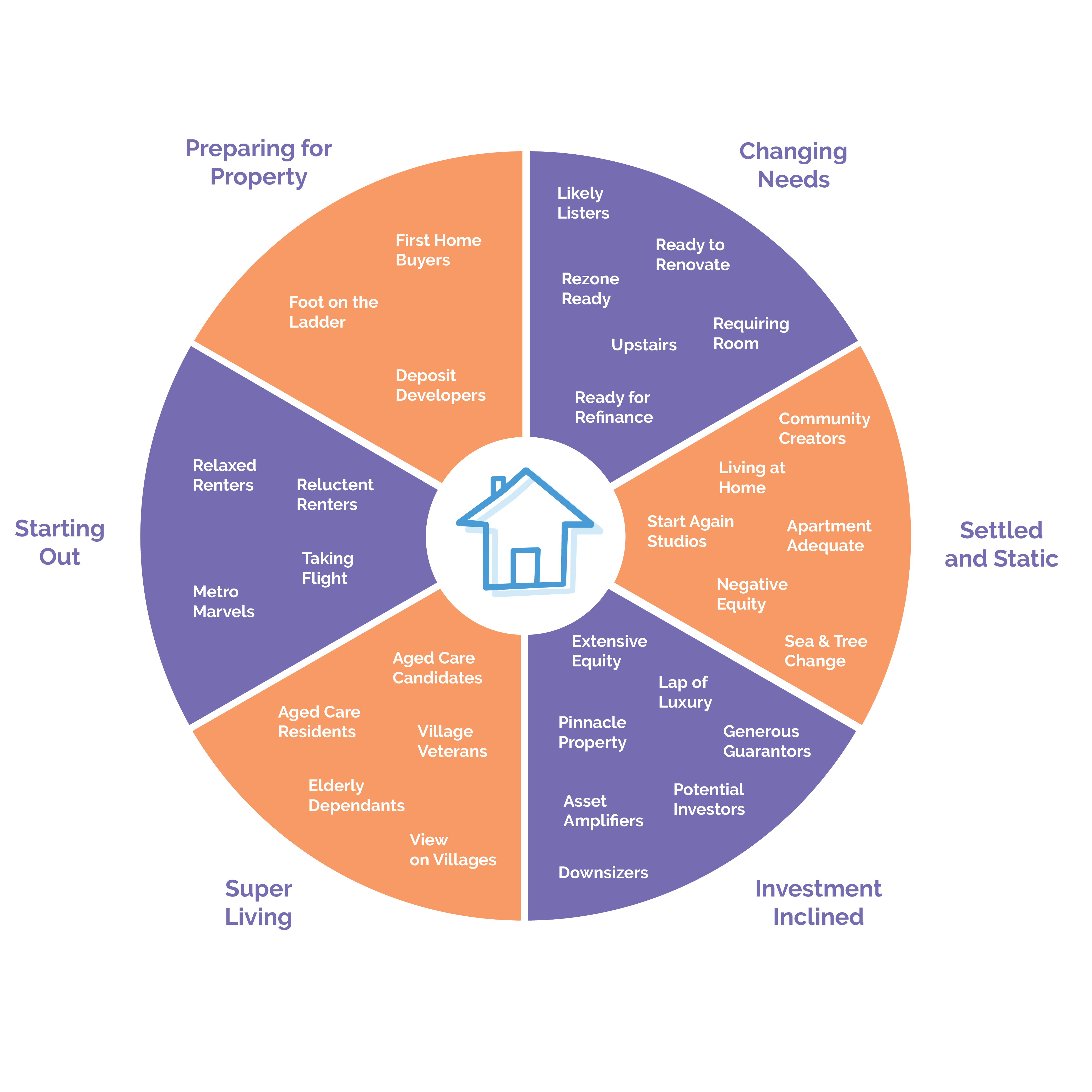

A complete view of Australian’s relationship with property

Access consumer audiences across all stages of the property ownership lifecycle – each with varying degrees of wealth, life events and buying habits.

Six key property lifestages

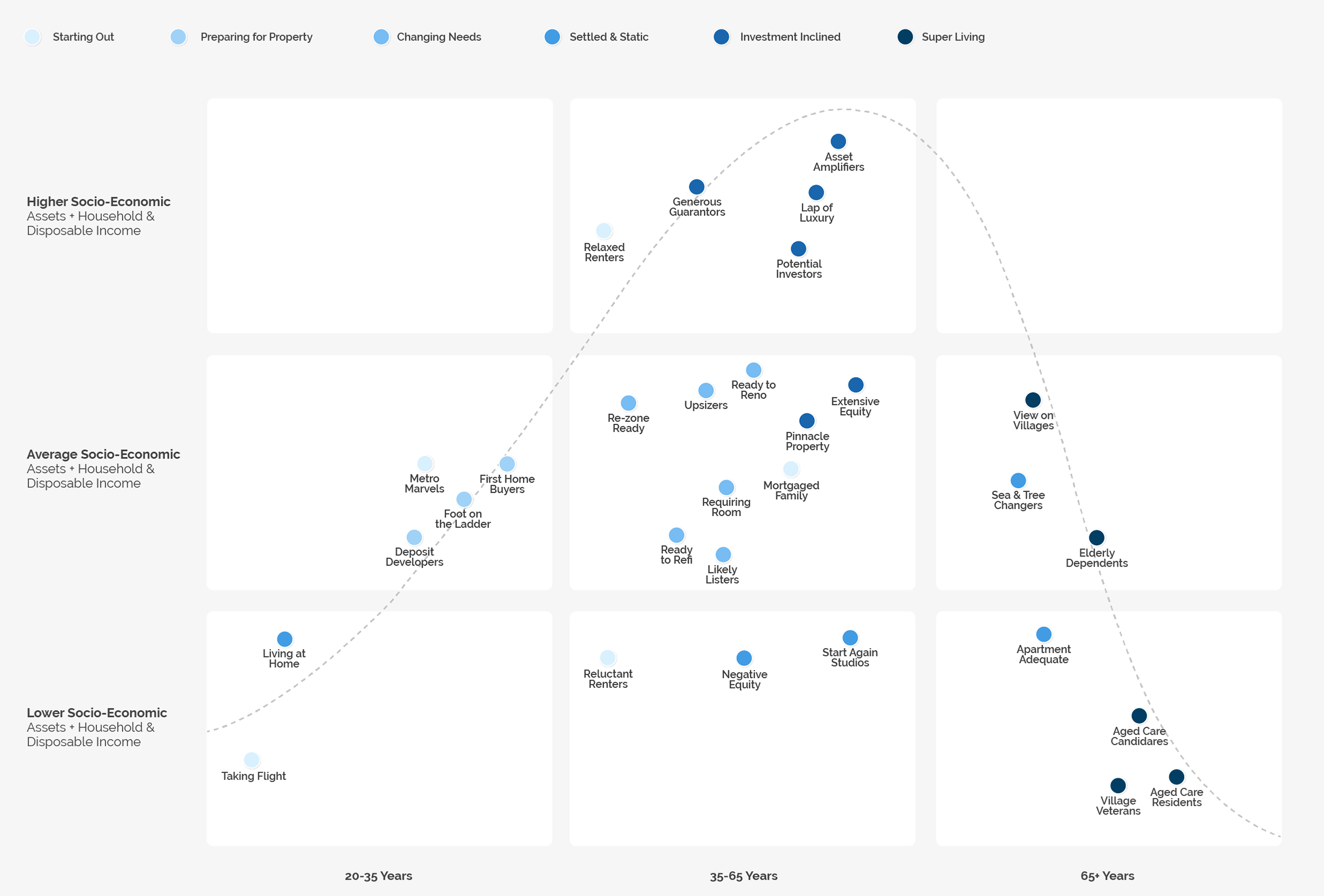

15 million Australians are attributed to 31 unique segments within 6 broad categories based on where they fall in the property spectrum. Each stage of the property journey is covered, from living at home or just moving out, to downsizing after the kids have left the nest.

-

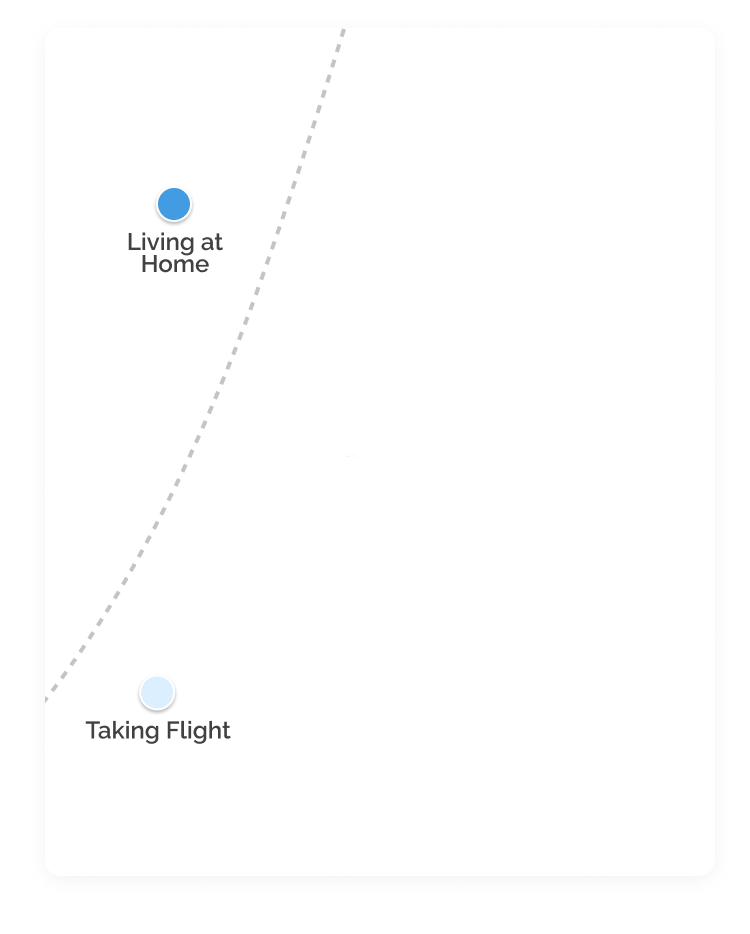

Starting out: Includes younger people about to move out of the family home, professionals renting inner-city apartments and individuals in their 20’s and 30’s who continue to rent reluctantly.

-

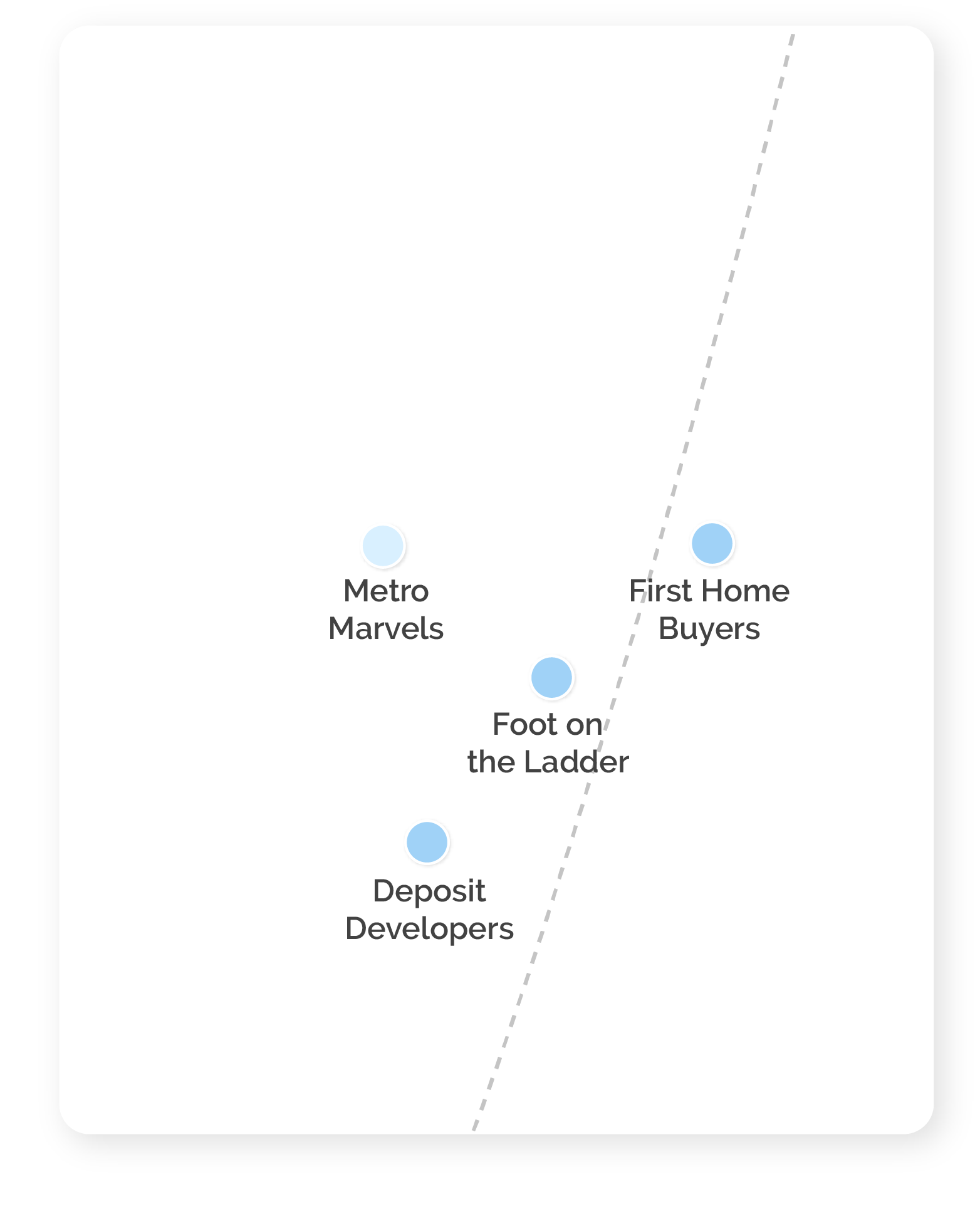

Preparing for property: Identifies Australians that are looking to purchase their first property. Whether it be an investment property or a first home, this is the first step for many into the great Australian dream.

-

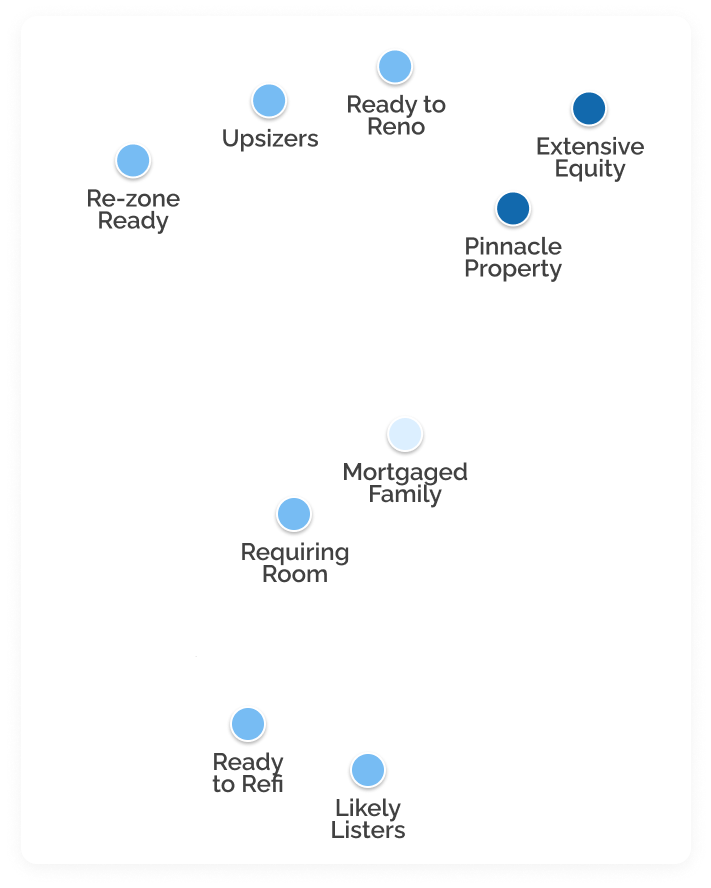

Changing needs: People likely to undertake significant property change include people looking to upsize, renovate or move into a newly rezoned house and land package.

-

Settled & static: Individuals unlikely to undertake change include young adults living at home and individuals who are happy to continue their inner-city apartment lifestyle.

-

Investment inclined: Property investors include wealthy white-collar professionals with substantial equity and older middle-income families that have grown their wealth through property.

-

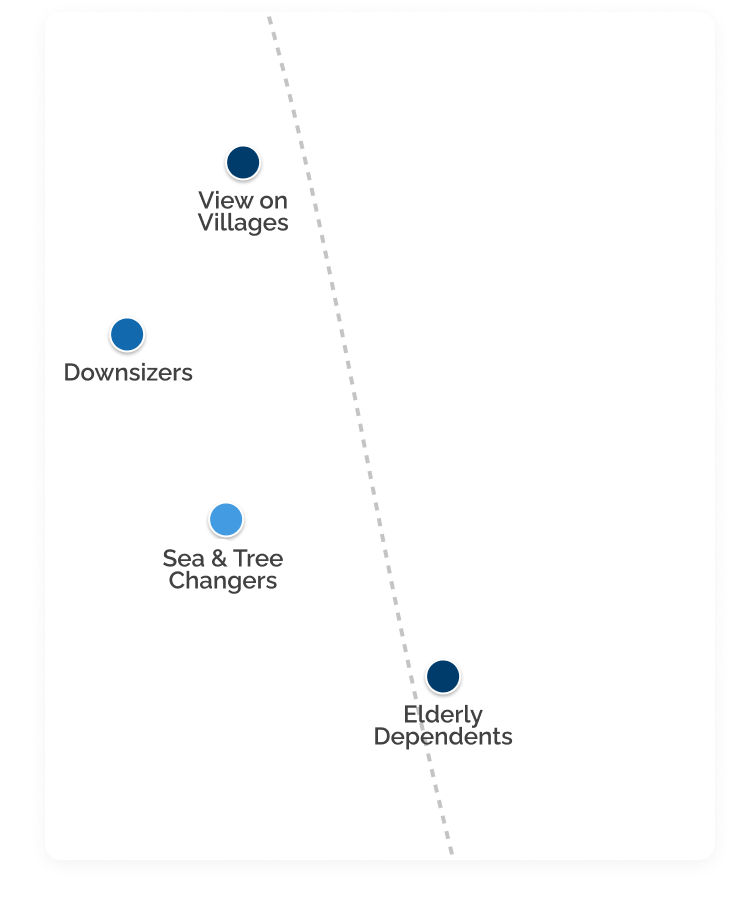

Super living: Retirement aged with a large proportion of the country’s wealth. Includes those living with families as elderly dependants and people considering retirement villages and aged care.

Spanning all lifestages and socio economic levels

Spanning all lifestages and socio economic levels

Tap on a section to zoom in.

Starting Out

Metro Marvels: Enjoy apartment living in and around the CBD. They prioritise having a short commute to work, and easy access to the large variety of eating and drinking venues the city has to offer. At this point in their lives, they are disinterested in a quiet suburban lifestyle, leaning towards the fast paced hustle of the inner city.

Relaxed Renters: Enjoy renting in affluent areas with easy access to the city. They could certainly afford to buy their own home, however, they are renting where they can enjoy the inner city lifestyle.

Taking Flight: Young adults who have entered rental accommodation. To save on rent they are often in shared rental situations – either with a partner or a couple of friends.

Reluctant Renters: Are currently priced out of the property market. They are renting in metropolitan areas until such a time they have the appropriate amount of savings and income to buy.

Preparing for Property

First Home Buyers: Having rented for a number of years, First Home Buyers are finally in a position to purchase their first home. They have their deposit saved, and are actively looking at properties in their surrounding area.

Deposit Developers: Are at a distinguished level of their careers. They have their house deposit almost saved thanks to smart savings and help from family.

Foot on the Ladder: Unwilling to reside any further out of the city, these individuals are looking to purchase an investment property on the city fringe in order to get a foot on the property ladder. They plan to utilise this strategy until such a time where they have built up enough equity to buy in an area which they find more desirable to live in.

Changing Needs

Ready to Refinance: Having lived in their home for several years, these owner-occupiers are looking to refinance for a multitude of potential reasons – a well overdue holiday, a much needed

renovation, or to consolidate debt.Ready to Renovate: Young, energetic, and likely to not yet have children. They are planning a significant renovation which will be partially funded through refinancing.

Likely Listers: Includes those that have resided in their home for many years and are looking for a change of scenery and those looking to enjoy substantial profit margins from a recent renovation.

Upsizers: Are likely to be looking to purchase a home larger than what they are currently residing in. They have enjoyed a few pay increases since they first purchased their home, and are looking forward to a size upgrade.

Re-Zone Ready: Are looking to move further out of the city to pursue a new house and land package in a newly rezoned area. This may be due to having an expanding family or a desire to enjoy a more substantial outdoor space.

Requiring Room: Already bursting at the seams, these families are likely to be searching for larger homes in less expensive areas than they are currently living in.

Settled and Static

Start Again Studios: Undergoing a new start after separation, they live in small studios or one bedroom apartments in metropolitan areas in order to stay close to their children and places of work.

Living at Home: Young adults, often enrolled in tertiary education, completing apprenticeships, or working their way up the corporate ladder. They live in a comfortable family home and realise the value of living rent-free until they can afford to rent or buy.

Negative Equity: Having purchased their property with only just enough to manage their mortgage repayments, this segment are experiencing the challenge of having their home drop in value.

Apartment Adequate: Are apartment owner-occupiers in metropolitan areas. They enjoy the convenience of having a home which is close to urban conveniences and requires little maintenance. They have no plans to upsize any time in the near future.

Sea and Tree Change: Have traded the city grind for a life with a slightly slower pace. They live in coastal or country towns, and are often retired from white and blue-collar careers.

Community Creators: Represent families who are enjoying the lifestyle that their newly created community holds. They are enjoying living in a spacious, modern home away from the city noise.

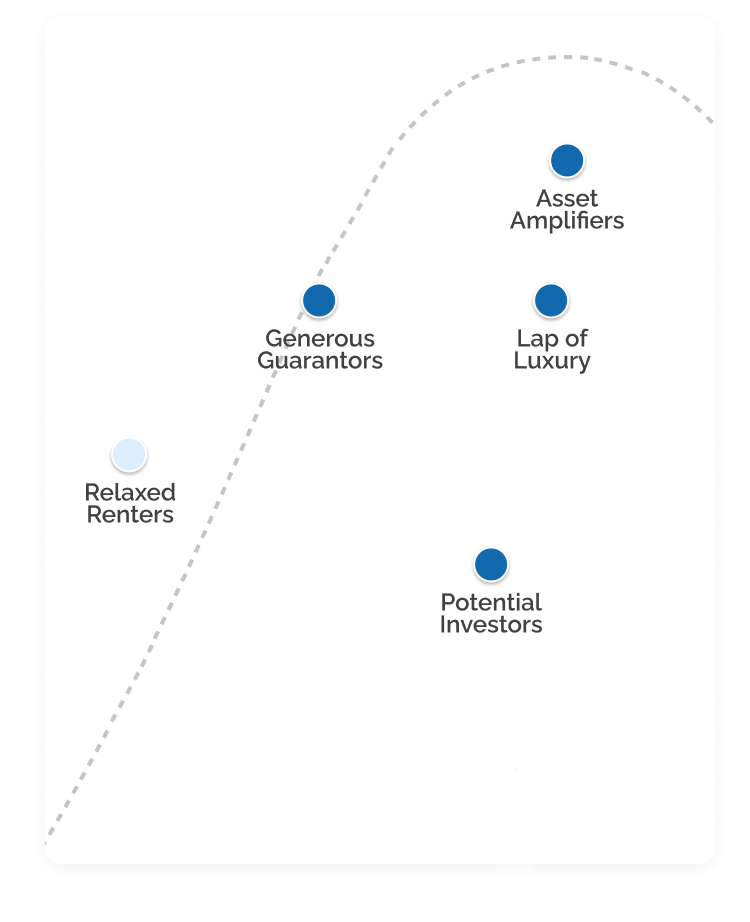

Investment Inclined

Asset Amplifiers: Well established and have been very clever in terms of their financial investments. With their accumulated wealth they are looking for up and coming suburbs for their next investment property.

Extensive Equity: Have lived in their home for a number of years without refinancing. They have a very significant amount of equity and experienced a large increase in the value of their property.

Potential Investors: Due to their current home having substantially increased in value, and a high household income, these individuals are in the perfect position to purchase their first investment property.

Lap of Luxury: Having experienced highly profitable investment returns, and enjoying vastly impressive household incomes, these individuals are enjoying a luxurious lifestyle in the country’s

most prestigious locations.Downsizers: Situated in large homes in the suburbs, Downsizers are no longer finding much use for their large homes. Their children have grown up and moved out, and they are experiencing difficulty maintaining such a large place.

Generous Guarantors: At a comfortable place financially, Generous Guarantors are willing to help their grown up children get a start on the property ladder by contributing to their first home deposit.

Pinnacle Property: At the pinnacle of their property life cycle, these individuals own the largest home they ever will, with a large backyard for their children and grandchildren to play in. They are likely to stay in this spacious estate for a long time.

Super Living

Aged Care Candidates: Are looking to move into an aged care residence for a number of reasons – namely those regarding health and mobility.

Aged Care Residents: Just as the name suggests, these retirees are living in aged care, usually for reasons relating to poor health and mobility.

Elderly Dependants: Have moved in with their grown up children, as a way to consolidate the family resources. They are able to help maintain the home and take care of their grandchildren.

View on Villages: These retirees are looking to trade in their suburban home for the easy going lifestyle of a retirement village.

Village Veterans: Having spent a few years in retirement villages, they enjoy the range of activities and sense of community on offer.

Use cases

The possibilities are endless, but the most common applications for this data asset include:

First home buyer targeting: Target people closest to buying their first home with financial products or residential property developments.

Investor targeting: Target more financially sophisticated individuals with financial products to meet their needs.

Custom segmentation: Feed property behaviour into a segmentation for a sub-sector of an industry. For example, understand the mortgage broker market as part of the wider mortgage market and see your business’s place within that sector.

Got Questions?

We have all the answers! Well, maybe not all but we’ll do our best to help.